Types of Sukuk

Sukuk are usually issued in accordance with an issuance contract in the following formats:

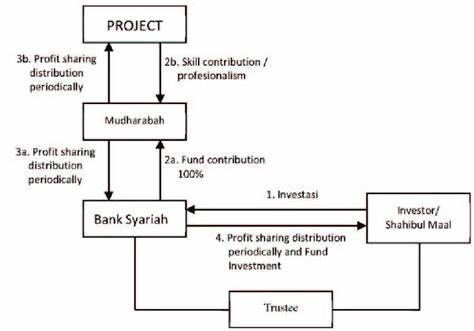

It is issued on the basis of a mudaraba contract between the sukuk holders and the beneficiary. The proceeds of its issuance are used to finance a specific economic activity or project managed by the beneficiary. The sukuk represents a common share in the ownership of the mudaraba assets. The sukuk returns are distributed from the profits generated by the activity or project according to the percentages specified in the contract, and its nominal value is returned at the end of its term from the activity or project.

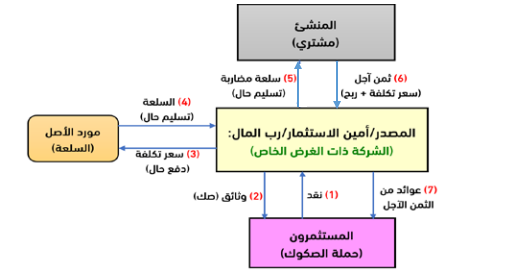

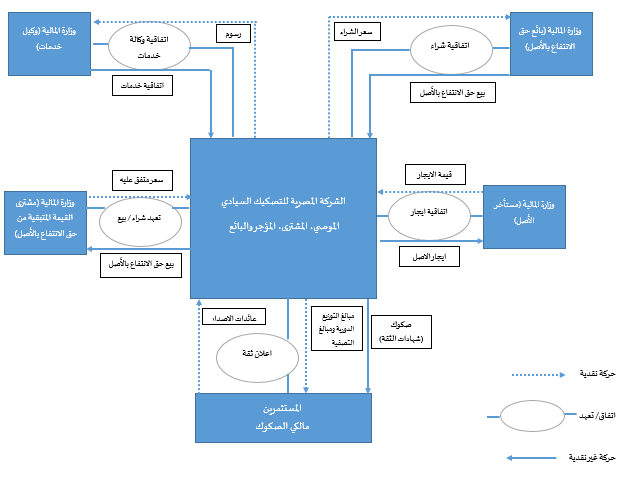

Issued on the basis of a Murabaha contract, the proceeds of its issuance are used by the sovereign sukuk company to finance the purchase of usufruct rights to Murabaha assets from a supplier or owner, with the aim of the sovereign sukuk company selling this right to the issuing entity. The sukuk represents a common share in the ownership of the usufruct rights to Murabaha assets after purchasing them from the supplier or owner, and then in the price to be paid by the issuing entity to the sovereign sukuk company. The return on these sukuks is the difference between the purchase price of the usufruct right paid by the sovereign sukuk company to the supplier or owner, and the sale price that the issuing entity is obligated to pay to the sovereign sukuk company. The issuing entity may sell the purchased usufruct right to a third party.

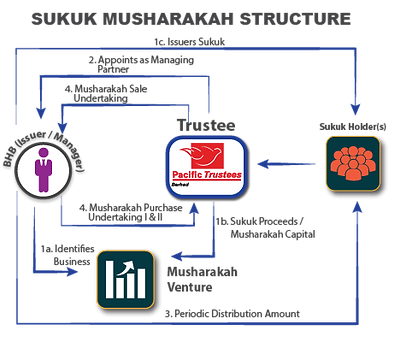

It is issued on the basis of a partnership contract, and the proceeds of its issuance are used to finance the establishment of a project, the development of an existing project, or to finance an activity based on partnership. The sukuk represents a common share in the ownership of the partnership assets, and the sukuk owners represent a share of the partnership profits in proportion to the number of sukuks owned by each of them.

Issued on the basis of a contract that includes the transfer of the right to use the assets, concluded between the issuing entity and the sovereign sukuk company, with the intention of leasing them to the issuing entity under a lease contract. The sukuk represents a common share in the right to use, and the return on these sukuks is due from the value of the rent paid by the issuing entity under the lease contract.

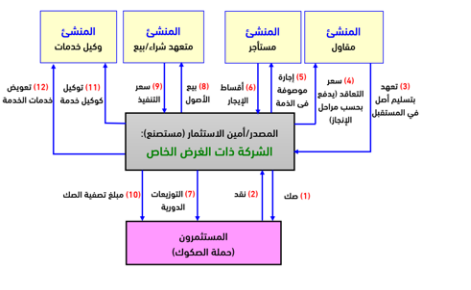

They are issued on the basis of istisna’a assets for the purpose of selling or leasing the usufruct rights of these assets. The sukuk represents a common share in the ownership of the usufruct rights of the manufactured assets. The return on these sukuks is derived from the net rental proceeds, the sale price of the usufruct rights, or the refund of istisna’a payments upon completion of the relevant purchase undertaking, subject to the following controls:

(a) The consideration for istisna’a must be known at the time of contracting and may be in cash, in kind, or a benefit for a specified period, whether the benefit is the manufactured item itself or another benefit offered by the issuing entity.

(b) Istisna’a sukuk may only be traded at nominal value and for a cash price after the transfer of the usufruct rights of the manufactured goods to the issuing entity.

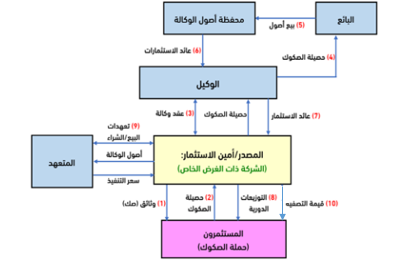

It is issued on the basis of an agency contract for investment in the usufruct rights of assets. The sovereign sukuk company is the investment agent, the sukuk owners are the principals, and the sukuk proceeds are the amount entrusted to be invested. The sukuk represents a common share in the usufruct rights of assets. The sovereign sukuk company, the investment agent, leases it. The sukuk return is the difference between the expected rental value and the original value for which the sukuk was issued.