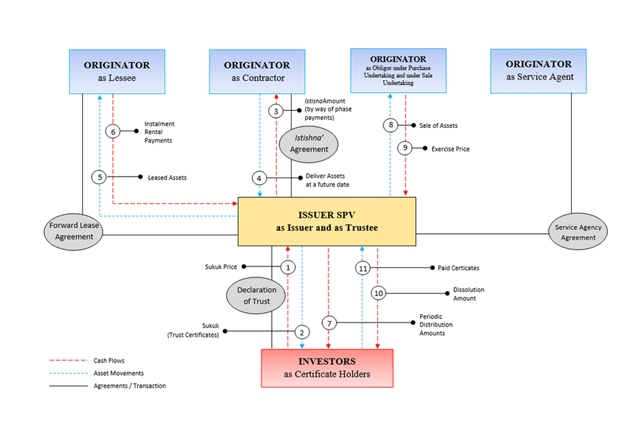

5) Istisna'a Sukuk:

Issued on the basis of istisna’a assets for the purpose of selling or leasing the usufruct rights of these assets. The sukuk represents a common share in the ownership of the usufruct rights of the manufactured assets. The proceeds from these sukuk are derived from the net rental proceeds, the sale price of the usufruct rights, or the refund of istisna’a payments upon completion of the relevant purchase undertaking, subject to the following controls:

(a) The consideration for the istisna’a must be known at the time of contracting and may be in cash, in kind, or a benefit for a specified period, whether the benefit of the manufactured item itself or another benefit offered by the istisna’a.

(b) Istisna’a Sukuk may only be traded at nominal value and for a cash price after the transfer of the usufruct rights of the manufactured goods to the issuing entity.