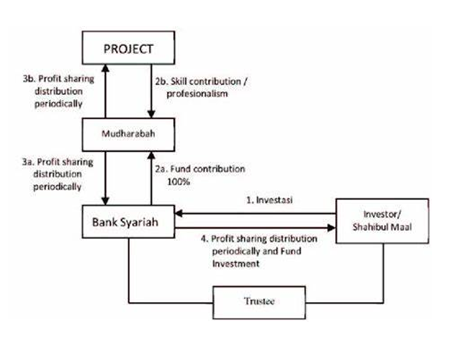

1) Mudaraba Sukuk

Issued based on a mudaraba contract between the sukuk holders and the beneficiary. The proceeds of the issuance are used to finance a specific economic activity or project managed by the

beneficiary. The sukuk represents a common share in the ownership of the mudaraba assets. The sukuk returns are

distributed from the profits generated by the activity or project according to the percentages specified in the contract, and the nominal value is returned at the end of the activity or project's

term.